BACKGROUND

Dr. Tasha M. Brown operates at the forefront of clinical psychology in New York, offering a spectrum of evidence-based services tailored for children, adolescents, and young adults. Her business, Tasha M. Brown, Ph.D., Psychological Services, PLLC, founded in 2019, distinguishes itself through a client-centered, strength-based therapeutic approach. This approach is rooted in Dr. Brown's dedication to seeing her clients successfully integrate treatment strategies into their everyday lives, thereby enhancing their functional adequacy across home, school, and community settings.

Educated at Syracuse University and DePaul University, where she completed her Ph.D. in Clinical Psychology, Dr. Brown further solidified her expertise with a Predoctoral Internship and Postdoctoral Fellowship at the University of Miami, Miller School of Medicine. Beyond her private practice, she contributes to the mental health field as a clinical psychologist at NewYork-Presbyterian Hospital and an Assistant Professor of Medical Psychology at Columbia University Medical Center.

Specializing in Parent-Child Interaction Therapy (PCIT), Parent Management Training (PMT), and Cognitive-Behavioral Therapy (CBT), Dr. Brown addresses a range of behavioral and emotional challenges. She is particularly adept at treating conditions such as disruptive behavior, inattention and hyperactivity, depression, anxiety, and adjustment disorders. Her work extends to young adults facing complex concerns related to life transitions, interpersonal relationships, anxiety, and mood disorders.

Dr. Brown's unique value proposition lies in her comprehensive approach to mental wellness, combining her clinical expertise with a deep understanding of family dynamics and school environments. This holistic perspective enables her to support not just the individuals in her care but also their families and educators, promoting overall mental health and well-being. Additionally, her role as a PCIT International Certified Within Agency trainer and her scholarly contributions to the fields of depression prevention and school consultation underscore her leadership and innovation in clinical psychology.

BACKGROUND

Dr. Tasha M. Brown operates at the forefront of clinical psychology in New York, offering a spectrum of evidence-based services tailored for children, adolescents, and young adults. Her business, Tasha M. Brown, Ph.D., Psychological Services, PLLC, founded in 2019, distinguishes itself through a client-centered, strength-based therapeutic approach. This approach is rooted in Dr. Brown's dedication to seeing her clients successfully integrate treatment strategies into their everyday lives, thereby enhancing their functional adequacy across home, school, and community settings.

Educated at Syracuse University and DePaul University, where she completed her Ph.D. in Clinical Psychology, Dr. Brown further solidified her expertise with a Predoctoral Internship and Postdoctoral Fellowship at the University of Miami, Miller School of Medicine. Beyond her private practice, she contributes to the mental health field as a clinical psychologist at NewYork-Presbyterian Hospital and an Assistant Professor of Medical Psychology at Columbia University Medical Center.

Specializing in Parent-Child Interaction Therapy (PCIT), Parent Management Training (PMT), and Cognitive-Behavioral Therapy (CBT), Dr. Brown addresses a range of behavioral and emotional challenges. She is particularly adept at treating conditions such as disruptive behavior, inattention and hyperactivity, depression, anxiety, and adjustment disorders. Her work extends to young adults facing complex concerns related to life transitions, interpersonal relationships, anxiety, and mood disorders.

Dr. Brown's unique value proposition lies in her comprehensive approach to mental wellness, combining her clinical expertise with a deep understanding of family dynamics and school environments. This holistic perspective enables her to support not just the individuals in her care but also their families and educators, promoting overall mental health and well-being. Additionally, her role as a PCIT International Certified Within Agency trainer and her scholarly contributions to the fields of depression prevention and school consultation underscore her leadership and innovation in clinical psychology.

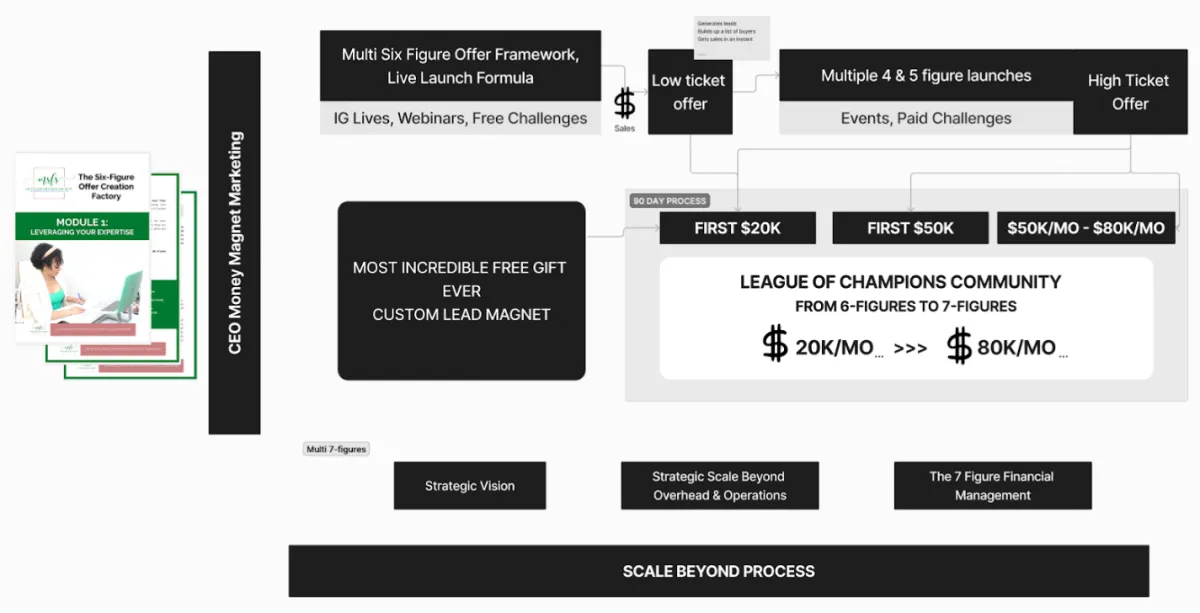

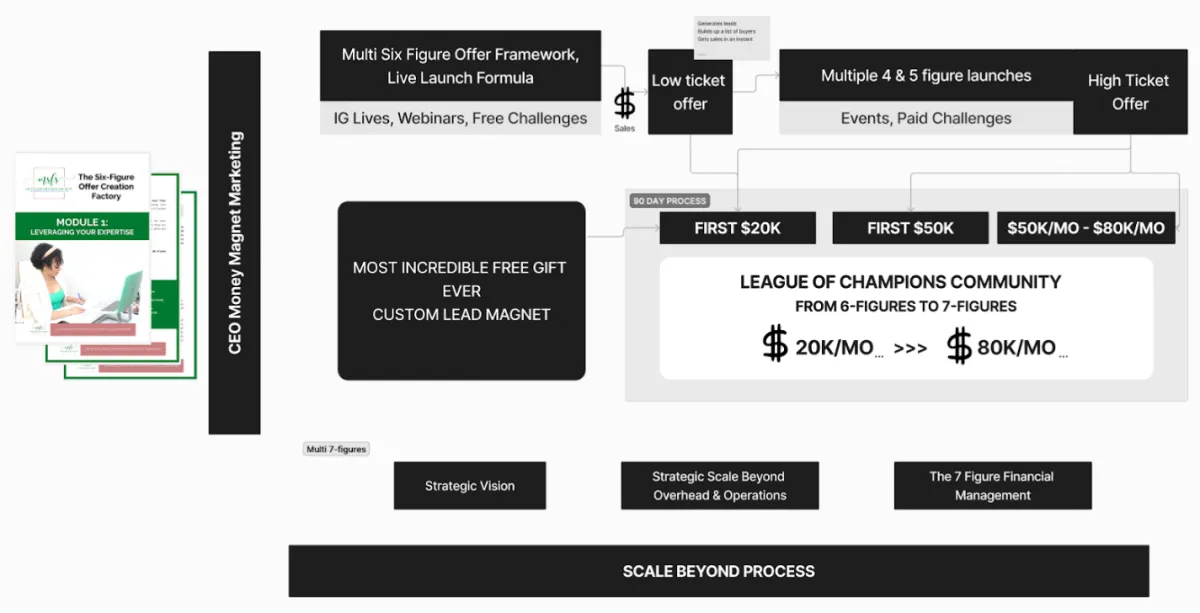

Scale Beyond 7 figures ™ Approach to Optimize Your Success!

Simply click here to schedule a personal consultation with me.

Challenge

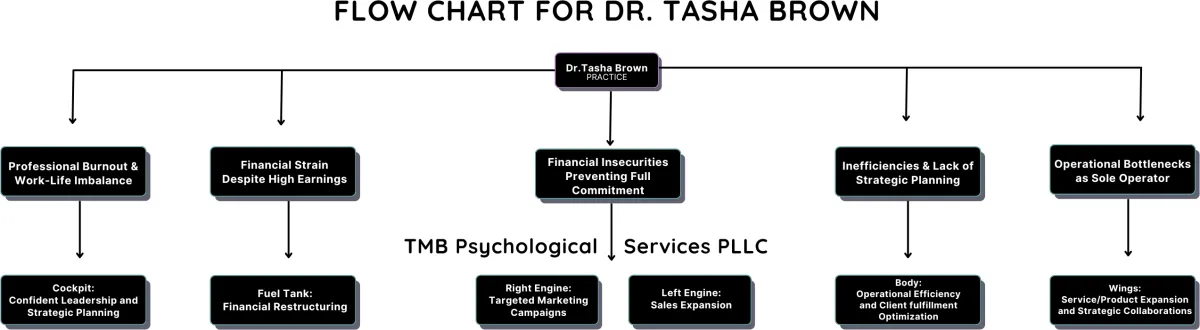

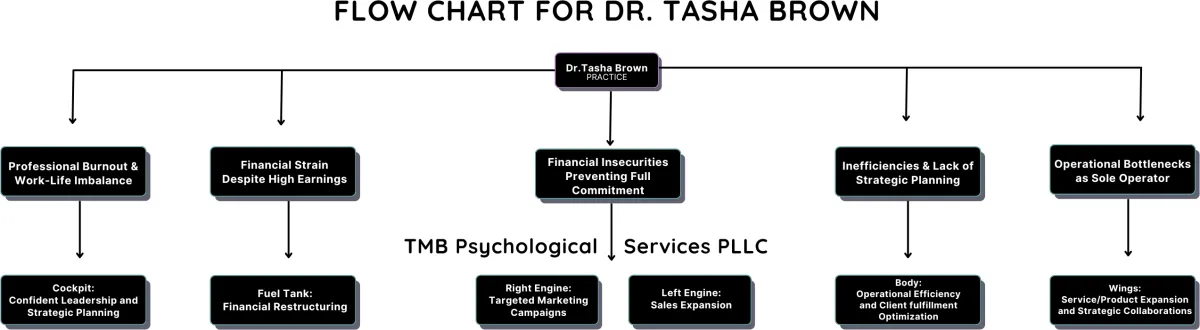

Despite Dr. Tasha M. Brown’s distinguished career and the success of her private practice, she encountered several formidable challenges that hindered her ability to scale her operations and achieve her full professional potential. These challenges prompted Dr. Brown to seek the expertise of the "Scale Beyond Seven Figures" Fractional C-Suite Services to navigate her way through these obstacles towards sustainable growth and personal fulfillment.

Professional Burnout and Work-Life Imbalance: Dr. Brown’s dedication to her roles across different prestigious institutions, coupled with managing her private practice, led to burnout. The sheer volume of her commitments left little room for personal time or enjoyment of her professional success, creating a significant work-life imbalance.

Financial Strain Despite High Earnings: Although her practice was financially successful on paper, Dr. Brown faced rising credit card and tax debt. The financial structure of her practice was not optimized, leading to a situation where her earnings did not translate into financial security or freedom. This was compounded by a significant tax burden, reducing her overall profitability and enjoyment of earned income.

Operational Bottlenecks as a Sole Operator: Dr. Brown's practice faced operational inefficiencies due to her position as the sole practitioner. This bottleneck resulted in a growing waiting list of potential clients, limiting the practice's growth and the ability to serve a broader client base. The operational structure did not support scalability or the efficient delivery of services.

Financial Insecurities Preventing Full Commitment: Her financial insecurities, exacerbated by the debt and inefficient tax structure, made it challenging for Dr. Brown to consider leaving her hospital position to focus entirely on her private practice. This indecision hindered her practice’s growth potential and her personal career development.

Inefficiencies and Lack of Strategic Planning: The practice lacked a cohesive strategy for growth, financial management, and operational efficiency. There was a clear need for strategic planning to align her practice’s operations with its financial goals, ensuring sustainable expansion and profitability.

Scale Beyond 7 figures ™ Approach to Optimize Your Success!

Simply click here to schedule a personal consultation with me.

Challenge

Despite Dr. Tasha M. Brown’s distinguished career and the success of her private practice, she encountered several formidable challenges that hindered her ability to scale her operations and achieve her full professional potential. These challenges prompted Dr. Brown to seek the expertise of the "Scale Beyond Seven Figures" Fractional C-Suite Services to navigate her way through these obstacles towards sustainable growth and personal fulfillment.

Professional Burnout and Work-Life Imbalance: Dr. Brown’s dedication to her roles across different prestigious institutions, coupled with managing her private practice, led to burnout. The sheer volume of her commitments left little room for personal time or enjoyment of her professional success, creating a significant work-life imbalance.

Financial Strain Despite High Earnings: Although her practice was financially successful on paper, Dr. Brown faced rising credit card and tax debt. The financial structure of her practice was not optimized, leading to a situation where her earnings did not translate into financial security or freedom. This was compounded by a significant tax burden, reducing her overall profitability and enjoyment of earned income.

Operational Bottlenecks as a Sole Operator: Dr. Brown's practice faced operational inefficiencies due to her position as the sole practitioner. This bottleneck resulted in a growing waiting list of potential clients, limiting the practice's growth and the ability to serve a broader client base. The operational structure did not support scalability or the efficient delivery of services.

Financial Insecurities Preventing Full Commitment: Her financial insecurities, exacerbated by the debt and inefficient tax structure, made it challenging for Dr. Brown to consider leaving her hospital position to focus entirely on her private practice. This indecision hindered her practice’s growth potential and her personal career development.

Inefficiencies and Lack of Strategic Planning: The practice lacked a cohesive strategy for growth, financial management, and operational efficiency. There was a clear need for strategic planning to align her practice’s operations with its financial goals, ensuring sustainable expansion and profitability.

Objectives

In addressing these challenges, Dr. Brown set forth specific objectives to be achieved through her

engagement with Natalie Taylor would would leverage "Scale Beyond Seven Figures"

Fractional C-Suite Services. Some of the objectives include:

To mitigate burnout and improve quality of life, a primary objective was to create a balanced approach that allowed for professional fulfillment without compromising personal well-being.

Streamlining operations to eliminate bottlenecks and improve client service was essential. This included the adoption of technology solutions, process improvements, and possibly expanding the team to increase capacity and efficiency.

Crafting a comprehensive strategic plan that aligned with her vision for the practice was imperative. This plan would guide decision-making, from marketing and client acquisition strategies to potential service expansions and collaborations, ensuring the practice’s sustainable growth.

Revamping the practice’s financial structure to reduce debt, maximize tax benefits, and increase profitability was crucial. This involved strategic financial planning, including debt restructuring and tax planning, to ensure financial stability and security.

With improved financial stability and operational efficiency, another key objective was for Dr. Brown to transition fully into her private practice. This meant reducing her reliance on her hospital position and focusing on strategically scaling her practice.

Scale Beyond 7 figures ™ Approach to Optimize Your Success!

Simply click here to schedule a personal consultation with me.

Objectives

In addressing these challenges, Dr. Brown set forth specific objectives to be achieved through her engagement with Natalie Taylor would would leverage "Scale Beyond Seven Figures" Fractional C-Suite Services. Some of the objectives include:

To mitigate burnout and improve quality of life, a primary objective was to create a balanced approach that allowed for professional fulfillment without compromising personal well-being.

Streamlining operations to eliminate bottlenecks and improve client service was essential. This included the adoption of technology solutions, process improvements, and possibly expanding the team to increase capacity and efficiency.

Crafting a comprehensive strategic plan that aligned with her vision for the practice was imperative. This plan would guide decision-making, from marketing and client acquisition strategies to potential service expansions and collaborations, ensuring the practice’s sustainable growth.

Revamping the practice’s financial structure to reduce debt, maximize tax benefits, and increase profitability was crucial. This involved strategic financial planning, including debt restructuring and tax planning, to ensure financial stability and security.

With improved financial stability and operational efficiency, another key objective was for Dr. Brown to transition fully into her private practice. This meant reducing her reliance on her hospital position and focusing on strategically scaling her practice.

Scale Beyond 7 figures ™ Approach to Optimize Your Success!

Simply click here to schedule a personal consultation with me.

Strategic Approach

The "Scale Beyond Seven Figures" framework was meticulously tailored to address Dr. Tasha M. Brown's unique set of challenges, with a comprehensive strategy and action plan designed to enhance growth, profitability, and operational efficiency. Recognizing the intricacies of Dr. Brown's situation, the approach combined robust financial restructuring, operational streamlining, and strategic planning with a focus on long-term sustainability and work-life balance.

Natalie Taylor, founder of "Scale Beyond Seven Figures," played a pivotal role in this transformative journey. She actively participated in key decision-making processes, including financial and tax planning, strategic planning sessions, and assessing the human resources implications of operational growth. Her involvement ensured that the strategies were not only aligned with the practice's goals but also grounded in financial and operational realities.

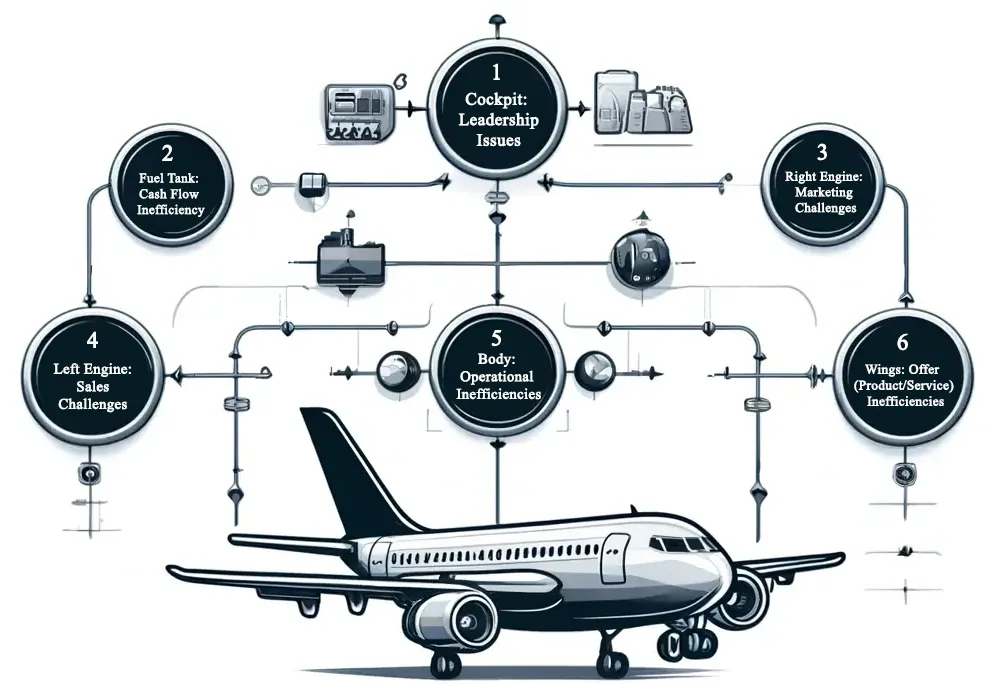

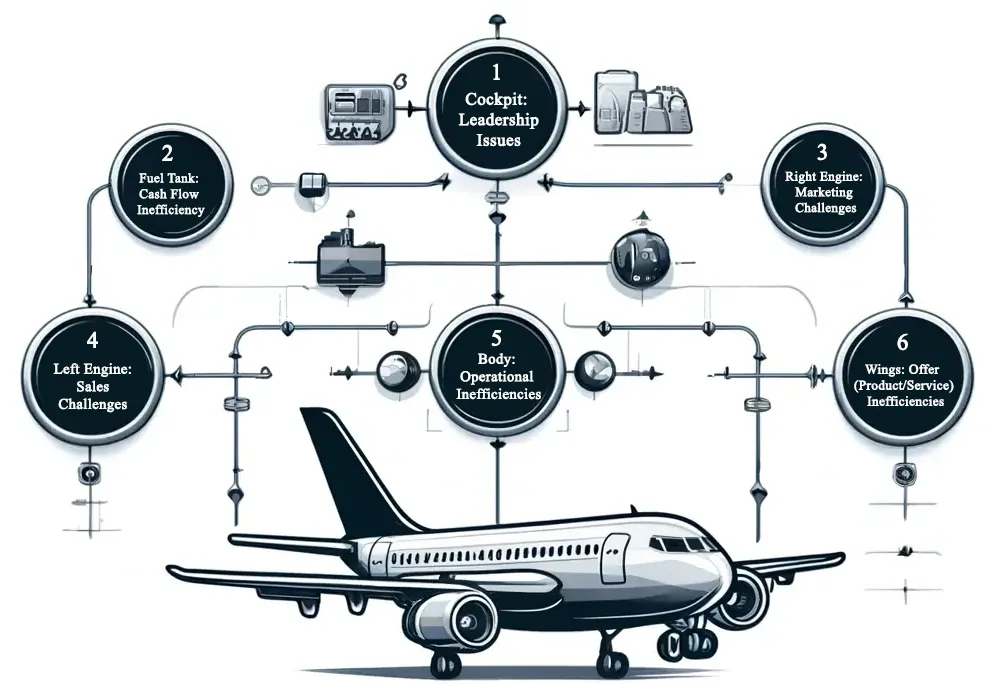

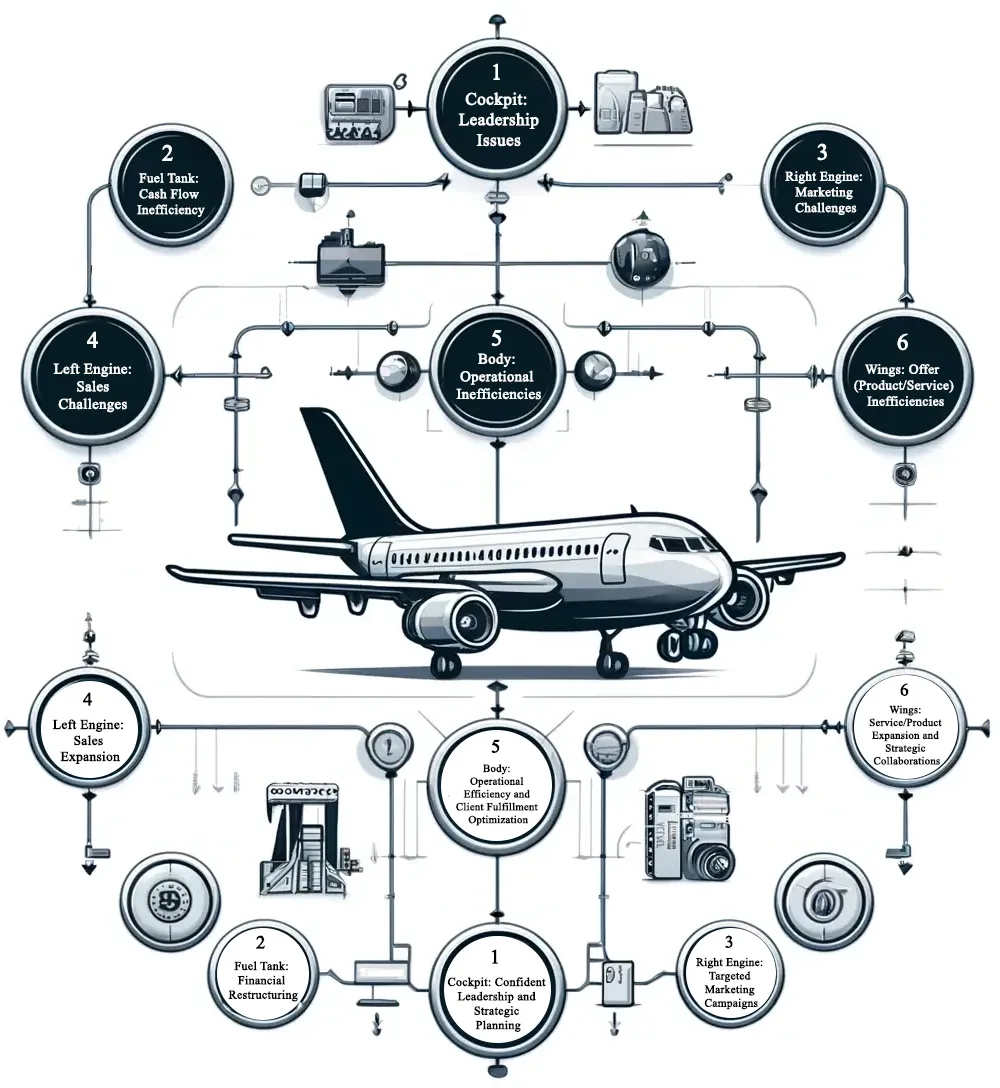

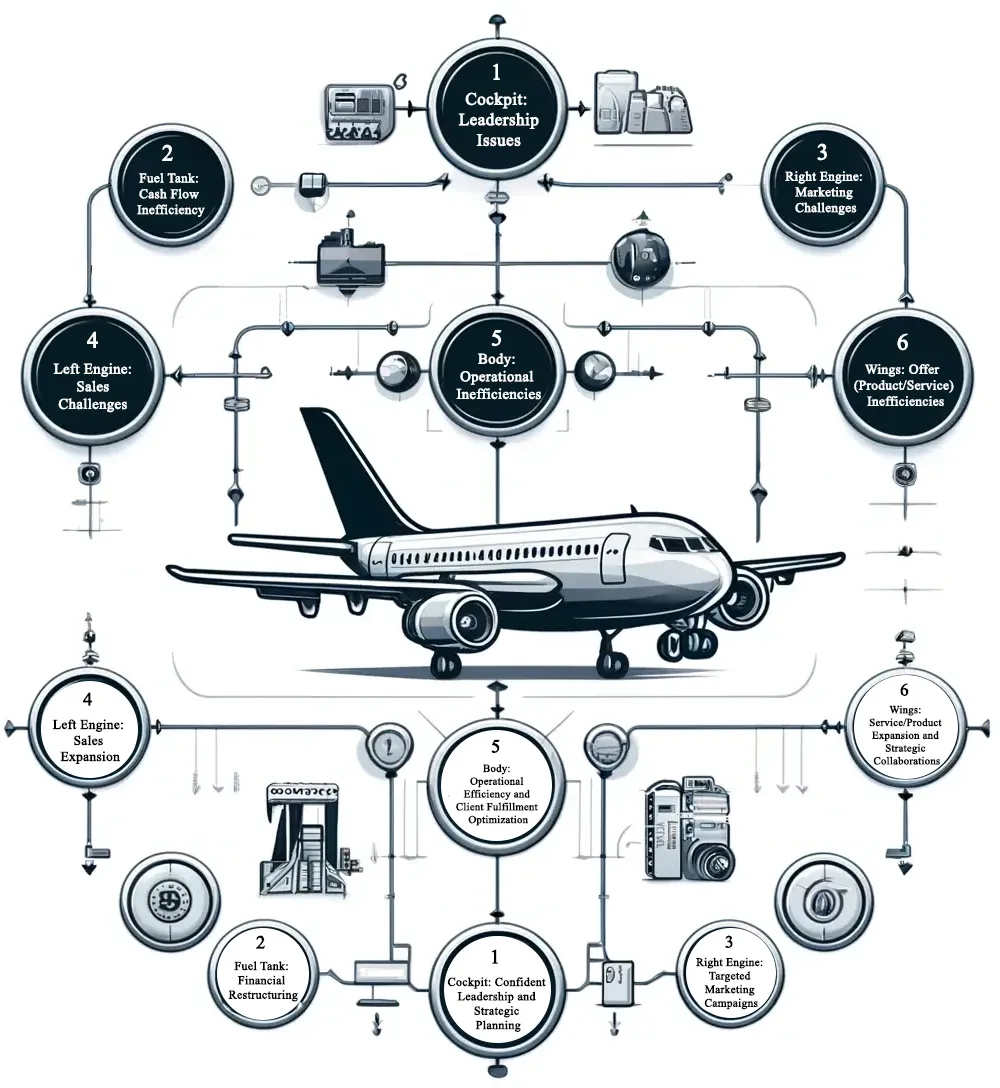

For this vision to materialize, each segment of the business—from leadership and strategy to operations and marketing—must be finely tuned and aligned.

This plane symbolizes the dream of every entrepreneur to run a successful organization where strategy, operations, cashflow, and marketing, sales, work in concert to propel the business forward, transforming bold visions into tangible success.

Fractional Leadership Roles

Natalie Taylor - As the leading figure in the engagement, Natalie provided overarching strategic direction, combining her expertise in financial planning and business growth strategies. She was instrumental in redefining the practice's financial architecture, focusing on leveraging the S-corp tax structure for efficiency, and guiding debt restructuring and budgeting to align with Dr. Brown's growth aspirations.

Financial Consultant - A fractional CFO role was introduced to drill down into the practice’s financial health, optimize tax strategies, and manage debt restructuring. This role was crucial for creating a sustainable financial model that supported growth while reducing financial stress.

Operational Specialist - To address the operational bottlenecks, a fractional COO role was engaged to streamline processes, implement systems for efficiency, and strategize on the hiring of new contractors to expand the practice’s capacity.

HR Consultant - With the decision to expand operations through new hires, an HR consultant position was leveraged to ensured that the practice not only attracted but also retained high-caliber talent, crucial for sustained growth and operational excellence.

Strategic Approach

The "Scale Beyond Seven Figures" framework was meticulously tailored to address Dr. Tasha M. Brown's unique set of challenges, with a comprehensive strategy and action plan designed to enhance growth, profitability, and operational efficiency. Recognizing the intricacies of Dr. Brown's situation, the approach combined robust financial restructuring, operational streamlining, and strategic planning with a focus on long-term sustainability and work-life balance.

Natalie Taylor, founder of "Scale Beyond Seven Figures," played a pivotal role in this transformative journey. She actively participated in key decision-making processes, including financial and tax planning, strategic planning sessions, and assessing the human resources implications of operational growth. Her involvement ensured that the strategies were not only aligned with the practice's goals but also grounded in financial and operational realities.

For this vision to materialize, each segment of the business—from leadership and strategy to operations and marketing—must be finely tuned and aligned.

This plane symbolizes the dream of every entrepreneur to run a successful organization where strategy, operations, cashflow, and marketing, sales, work in concert to propel the business forward, transforming bold visions into tangible success.

Fractional Leadership Roles

Natalie Taylor - As the leading figure in the engagement, Natalie provided overarching strategic direction, combining her expertise in financial planning and business growth strategies. She was instrumental in redefining the practice's financial architecture, focusing on leveraging the S-corp tax structure for efficiency, and guiding debt restructuring and budgeting to align with Dr. Brown's growth aspirations.

Financial Consultant - A fractional CFO role was introduced to drill down into the practice’s financial health, optimize tax strategies, and manage debt restructuring. This role was crucial for creating a sustainable financial model that supported growth while reducing financial stress.

Operational Specialist - To address the operational bottlenecks, a fractional COO role was engaged to streamline processes, implement systems for efficiency, and strategize on the hiring of new contractors to expand the practice’s capacity.

HR Consultant - With the decision to expand operations through new hires, an HR consultant position was leveraged to ensured that the practice not only attracted but also retained high-caliber talent, crucial for sustained growth and operational excellence.

Strategic Approach

The "Scale Beyond Seven Figures" framework was meticulously tailored to address Dr. Tasha M. Brown's unique set of challenges, with a comprehensive strategy and action plan designed to enhance growth, profitability, and operational efficiency. Recognizing the intricacies of Dr. Brown's situation, the approach combined robust financial restructuring, operational streamlining, and strategic planning with a focus on long-term sustainability and work-life balance.

Natalie Taylor, founder of "Scale Beyond Seven Figures," played a pivotal role in this transformative journey. She actively participated in key decision-making processes, including financial and tax planning, strategic planning sessions, and assessing the human resources implications of operational growth. Her involvement ensured that the strategies were not only aligned with the practice's goals but also grounded in financial and operational realities.

Fractional Leadership Roles

Natalie Taylor - As the leading figure in the engagement, Natalie provided overarching strategic direction, combining her expertise in financial planning and business growth strategies. She was instrumental in redefining the practice's financial architecture, focusing on leveraging the S-corp tax structure for efficiency, and guiding debt restructuring and budgeting to align with Dr. Brown's growth aspirations.

Financial Consultant - A fractional CFO role was introduced to drill down into the practice’s financial health, optimize tax strategies, and manage debt restructuring. This role was crucial for creating a sustainable financial model that supported growth while reducing financial stress.

Operational Specialist - To address the operational bottlenecks, a fractional COO role was engaged to streamline processes, implement systems for efficiency, and strategize on the hiring of new contractors to expand the practice’s capacity.

HR Consultant - With the decision to expand operations through new hires, an HR consultant position was leveraged to ensured that the practice not only attracted but also retained high-caliber talent, crucial for sustained growth and operational excellence.

Execution

The implementation process was characterized by a phased approach, beginning with an in-depth financial and operational assessment. This initial phase involved a rigorous analysis of financial statements to inform data-driven decisions, alongside strategic planning to identify key areas for operational improvement.

Financial and Tax Planning - Natalie Taylor spearheaded the financial restructuring, closely working with Dr. Tasha’s financial consultant and new tax expert that was retained to recalibrate the practice's tax strategies and budgeting. This phase involved calculating the financial impact of the restructuring, ensuring that the practice could leverage tax efficiencies while positioning itself for scalable growth. Dr. Brown was able to leverage having the presence of Ms. Taylor to lead and guide conversation to maximize the results negotiated.

Operational Streamlining and HR Strategy - The operational specialist focused on eliminating bottlenecks by optimizing workflows and laying the groundwork for scaling the practice's capacity. This included planning for the hiring of new contractors, with the HR consultant developing competitive compensation packages and fostering a culture that attracted top talent.

Challenges and Solutions - Throughout the implementation, the team encountered challenges such as aligning the new financial strategies with existing operational processes and integrating new hires into the practice’s culture. These challenges were met with adaptive strategies, including continuous coaching and consulting support from Natalie Taylor and her team, ensuring that Dr. Brown and her practice could navigate the complexities of transformation successfully.

This holistic combination of coaching, consulting, and hands-on leadership facilitated by Natalie Taylor and the fractional C-suite professionals led to significant improvements in Dr. Brown's practice. By focusing on strategic financial management, operational efficiency, and strategic hiring, the practice was not only able to overcome its initial challenges but also position itself for sustainable growth and success.

Execution

The implementation process was characterized by a phased approach, beginning with an in-depth financial and operational assessment. This initial phase involved a rigorous analysis of financial statements to inform data-driven decisions, alongside strategic planning to identify key areas for operational improvement.

Financial and Tax Planning - Natalie Taylor spearheaded the financial restructuring, closely working with Dr. Tasha’s financial consultant and new tax expert that was retained to recalibrate the practice's tax strategies and budgeting. This phase involved calculating the financial impact of the restructuring, ensuring that the practice could leverage tax efficiencies while positioning itself for scalable growth. Dr. Brown was able to leverage having the presence of Ms. Taylor to lead and guide conversation to maximize the results negotiated.

Operational Streamlining and HR Strategy - The operational specialist focused on eliminating bottlenecks by optimizing workflows and laying the groundwork for scaling the practice's capacity. This included planning for the hiring of new contractors, with the HR consultant developing competitive compensation packages and fostering a culture that attracted top talent.

Challenges and Solutions - Throughout the implementation, the team encountered challenges such as aligning the new financial strategies with existing operational processes and integrating new hires into the practice’s culture. These challenges were met with adaptive strategies, including continuous coaching and consulting support from Natalie Taylor and her team, ensuring that Dr. Brown and her practice could navigate the complexities of transformation successfully.

This holistic combination of coaching, consulting, and hands-on leadership facilitated by Natalie Taylor and the fractional C-suite professionals led to significant improvements in Dr. Brown's practice. By focusing on strategic financial management, operational efficiency, and strategic hiring, the practice was not only able to overcome its initial challenges but also position itself for sustainable growth and success.

Results and Impact

The strategic overhaul and targeted interventions led by Natalie Taylor and the "Scale Beyond Seven Figures" team have had a profound impact on Dr. Tasha M. Brown's practice, yielding significant quantitative and qualitative outcomes.

Quantitative Outcomes:

Dr. Brown's practice experienced substantial revenue growth as a direct result of operational streamlining and the elimination of the long waiting list. By expanding her team and improving operational efficiency, she was able to serve a larger client base, significantly increasing her practice's earnings.

The financial restructuring, including debt restructuring and optimized tax strategies, resulted in notable cost savings. By leveraging the S-corp structure and identifying previously missed opportunities for tax deductions, Dr. Brown significantly reduced her practice's tax liabilities and operational costs.

Dr. Brown has solidified her position in the market, moving from a long waiting list to actively growing her client base. This expansion is not only a testament to her practice's increased capacity but also to the rising demand for her specialized services.

Qualitative Improvements:

With the fractional C-suite team addressing financial and operational challenges, Dr. Brown has been able to redirect her focus towards strategic growth and service excellence. This shift has allowed her to explore new avenues for expansion, including public relations and content creation.

Dr. Brown now enjoys more personal travel and has enhanced her public relations efforts. With a competent team managing day-to-day operations, she has the bandwidth to engage in activities that increase her visibility and position her as a leading expert in her field. Regular appearances on national TV and her successful podcasting ventures have elevated her profile significantly.

Results and Impact

The strategic overhaul and targeted interventions led by Natalie Taylor and the "Scale Beyond Seven Figures" team have had a profound impact on Dr. Tasha M. Brown's practice, yielding significant quantitative and qualitative outcomes.

Quantitative Outcomes:

Dr. Brown's practice experienced substantial revenue growth as a direct result of operational streamlining and the elimination of the long waiting list. By expanding her team and improving operational efficiency, she was able to serve a larger client base, significantly increasing her practice's earnings.

The financial restructuring, including debt restructuring and optimized tax strategies, resulted in notable cost savings. By leveraging the S-corp structure and identifying previously missed opportunities for tax deductions, Dr. Brown significantly reduced her practice's tax liabilities and operational costs.

Dr. Brown has solidified her position in the market, moving from a long waiting list to actively growing her client base. This expansion is not only a testament to her practice's increased capacity but also to the rising demand for her specialized services.

Qualitative Improvements:

With the fractional C-suite team addressing financial and operational challenges, Dr. Brown has been able to redirect her focus towards strategic growth and service excellence. This shift has allowed her to explore new avenues for expansion, including public relations and content creation.

Dr. Brown now enjoys more personal travel and has enhanced her public relations efforts. With a competent team managing day-to-day operations, she has the bandwidth to engage in activities that increase her visibility and position her as a leading expert in her field. Regular appearances on national TV and her successful podcasting ventures have elevated her profile significantly.

Why Scale Beyond ™ Frameworks ?

Testimonial for Dr. Tasha Brown

Analysis and Lessons Learned

Initiating the engagement with a comprehensive business assessment, including a coaching onboarding session and a detailed review of financial statements, proved instrumental. This foundational step allowed for a clear understanding of the practice's revenue streams, expenses, turnover ratio, debt-to-equity ratio, and the reasons behind the high tax liabilities. Gaining insight into both the business and personal earnings of Dr. Brown set the stage for tailored financial and operational strategies.

Identifying Weaknesses and Needs: Directly engaging with Dr. Brown to assess her perceived weaknesses and needs of the company was a crucial step. This not only ensured that the strategies developed were aligned with her priorities but also helped in uncovering hidden challenges within the practice.

Expert Collaboration: Facilitating conversations between Dr. Brown and other experts in areas where she lacked the knowledge to fully articulate her needs was a game-changer. This approach helped in addressing problems she was not previously aware of, leveraging the expertise of fractional leaders to bring about solutions that were previously unconsidered.

Financial Efficiency: The structure of making one comprehensive payment for a suite of services significantly alleviated financial strain on the company. This approach provided Dr. Brown with access to a range of expert insights and services without the additional financial burden that typically accompanies hiring multiple consultants or full-time C-suite executives.

Areas for Improvement

The success of this engagement underscores the value of evolving from a one-time comprehensive intervention to a model of ongoing support. This approach can offer businesses, especially those led by experts in their field, the flexibility to grow and adapt while continuously monitoring their operational and financial health. It also allows for incremental adjustments to strategies as the business evolves.

Adopting a payment structure that combines an initial assessment fee with ongoing, smaller payments for continuous support could be more attractive and financially feasible for clients. This model supports sustainable growth for the client while ensuring they have access to expert advice and interventions as needed, without the significant upfront cost of hiring a full-time C-suite team or multiple consultants.

The engagement highlighted the efficiency and effectiveness of leveraging fractional C-suite professionals for expert-led organizations. By accessing high-caliber expertise on an as-needed basis, businesses can navigate complex challenges and seize growth opportunities without the hefty financial commitment of full-time executive salaries or numerous consulting fees.

Early and thorough assessments of a business's operational and financial landscapes are critical. They not only inform the development of tailored strategies but also help in identifying underlying issues that may not be immediately apparent to the business owner. This process is invaluable in setting the stage for successful interventions and long-term growth.

Analysis and Lessons Learned

Initiating the engagement with a comprehensive business assessment, including a coaching onboarding session and a detailed review of financial statements, proved instrumental. This foundational step allowed for a clear understanding of the practice's revenue streams, expenses, turnover ratio, debt-to-equity ratio, and the reasons behind the high tax liabilities. Gaining insight into both the business and personal earnings of Dr. Brown set the stage for tailored financial and operational strategies.

Identifying Weaknesses and Needs: Directly engaging with Dr. Brown to assess her perceived weaknesses and needs of the company was a crucial step. This not only ensured that the strategies developed were aligned with her priorities but also helped in uncovering hidden challenges within the practice.

Expert Collaboration: Facilitating conversations between Dr. Brown and other experts in areas where she lacked the knowledge to fully articulate her needs was a game-changer. This approach helped in addressing problems she was not previously aware of, leveraging the expertise of fractional leaders to bring about solutions that were previously unconsidered.

Financial Efficiency: The structure of making one comprehensive payment for a suite of services significantly alleviated financial strain on the company. This approach provided Dr. Brown with access to a range of expert insights and services without the additional financial burden that typically accompanies hiring multiple consultants or full-time C-suite executives.

Areas for Improvement

The success of this engagement underscores the value of evolving from a one-time comprehensive intervention to a model of ongoing support. This approach can offer businesses, especially those led by experts in their field, the flexibility to grow and adapt while continuously monitoring their operational and financial health. It also allows for incremental adjustments to strategies as the business evolves.

Adopting a payment structure that combines an initial assessment fee with ongoing, smaller payments for continuous support could be more attractive and financially feasible for clients. This model supports sustainable growth for the client while ensuring they have access to expert advice and interventions as needed, without the significant upfront cost of hiring a full-time C-suite team or multiple consultants.

The engagement highlighted the efficiency and effectiveness of leveraging fractional C-suite professionals for expert-led organizations. By accessing high-caliber expertise on an as-needed basis, businesses can navigate complex challenges and seize growth opportunities without the hefty financial commitment of full-time executive salaries or numerous consulting fees.

Early and thorough assessments of a business's operational and financial landscapes are critical. They not only inform the development of tailored strategies but also help in identifying underlying issues that may not be immediately apparent to the business owner. This process is invaluable in setting the stage for successful interventions and long-term growth.

COPYRIGHT © 2024 Scale Beyond. ALL RIGHTS RESERVED.